Daniel Kahneman warned us:

“We’re generally overconfident in our predictions, especially when we have a lot riding on them.”

In financial forecasting, this 𝐨𝐩𝐭𝐢𝐦𝐢𝐬𝐦 𝐛𝐢𝐚𝐬 𝐬𝐡𝐨𝐰𝐬 𝐮𝐩 𝐞𝐯𝐞𝐫𝐲𝐰𝐡𝐞𝐫𝐞:

Sales targets built on emotion, not evidence.

“Best-case” forecasts presented as expected outcomes.

Pipeline deals marked 90% likely… with 𝐧𝐨 𝐡𝐢𝐬𝐭𝐨𝐫𝐢𝐜𝐚𝐥 𝐜𝐥𝐨𝐬𝐞 𝐫𝐚𝐭𝐞 𝐭𝐨 𝐛𝐚𝐜𝐤 𝐢𝐭 𝐮𝐩.

As Fractional CFOs, we help founders and teams de-bias their forecasts using a few tools Kahneman would approve of:

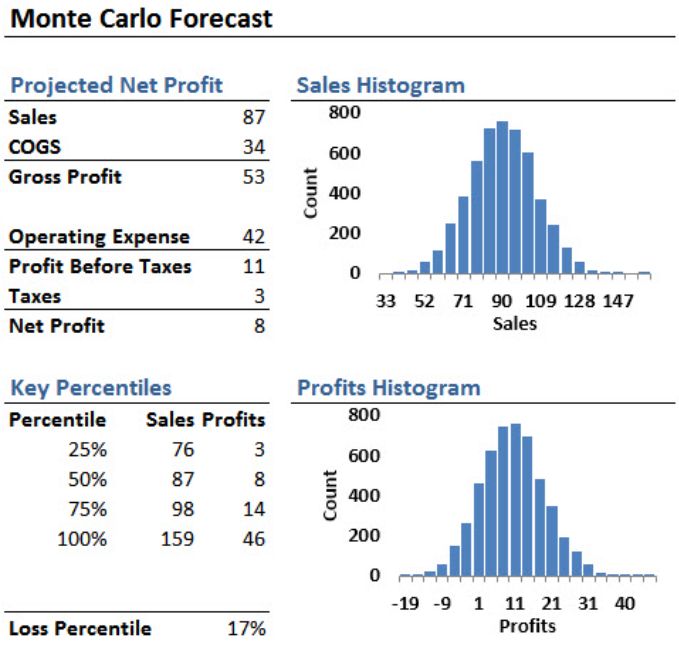

📊 𝐌𝐨𝐧𝐭𝐞 𝐂𝐚𝐫𝐥𝐨 𝐬𝐢𝐦𝐮𝐥𝐚𝐭𝐢𝐨𝐧𝐬 –

We run 1,000+ probabilistic scenarios to show the range of outcomes—not just the one we want to believe. Suddenly, risk becomes visible, and runway planning becomes real.

🔁 𝐑𝐞𝐟𝐞𝐫𝐞𝐧𝐜𝐞 𝐜𝐥𝐚𝐬𝐬 𝐟𝐨𝐫𝐞𝐜𝐚𝐬𝐭𝐢𝐧𝐠 –

We don’t just ask “What do we expect?” — we ask “What’s actually happened in similar periods?”

🧩 𝐏𝐫𝐞-𝐦𝐨𝐫𝐭𝐞𝐦𝐬 –

Before the quarter even starts, we assume failure and work backward to stress-test every assumption.

The result? Sharper decisions. Cleaner cash flow. Fewer surprises.

Kahneman put it simply:

“The idea that the 𝐟𝐮𝐭𝐮𝐫𝐞 𝐢𝐬 𝐮𝐧𝐩𝐫𝐞𝐝𝐢𝐜𝐭𝐚𝐛𝐥𝐞 𝐢𝐬 𝐮𝐧𝐝𝐞𝐫𝐦𝐢𝐧𝐞𝐝 𝐞𝐯𝐞𝐫𝐲 𝐝𝐚𝐲 by the ease with which the past is explained.”

✨ Forecast with humility. Operate with clarity.

💬 How does your team challenge its assumptions?

using WordPress and

using WordPress and

No responses yet